AI's massive cash needs are Big Tech's chance to own the future

Are a handful of companies monopolizing the AI boom?

An earlier version of this post originally appeared on AI Supremacy.

Over the past year, AI startups have raised some impressive amounts of money. OpenAI raised $10 billion, Anthropic did $6 billion, Inflection AI raised $1.3 billion, and dozens of companies closed rounds in the hundreds of millions.

If you're a casual observer of the AI boom, there are two important things that you might not realize. First, these aren't normal sized funding rounds. To put it in perspective, in 2023 there were only ten startup funding rounds of a billion or more - and more than half went to AI or ML companies.

Second, when you peek behind the curtain, it turns out that a lot of these rounds share a narrow set of investors: Google, Amazon, Microsoft, and Nvidia. That makes some sense: there are only so many investors with deep enough pockets to provide billions in capital. But it's creating the opportunity for a handful of companies to own increasingly bigger stakes in the next wave of AI darlings.

So let's take a look at why AI companies need so much cash - and whether we should be worried that a handful of tech giants are behind their mega funding rounds.

Feeding the money machine

Unlike say, SaaS companies, AI startups have very different capital needs. The last wave of consumer apps and B2B software was marked by "blitzscaling," where companies that achieved product-market fit (or sometimes, even if they hadn't) would incinerate cash in order to grow at unsustainably incredibly fast rates. Depending on the company, this meant paying for marketing, hiring salespeople, or subsidizing users. Personally, I'm going to miss the era of cheap Lyft rides and DoorDash deliveries.

But AI startups aren't (yet) spending tons of cash on growth. They're spending it on product. Foundation models like GPT-4 or Claude need hundreds of millions of dollars to train, and millions more to run at scale. These upfront costs go towards data collection, training runs, and fine tuning.

As just one data point, consider Scale AI: it provides data labeling services to AI companies. With the boom in RLHF (reinforcement learning from human feedback), the company grew its annual revenue from $250 million to $750 million in under two years.

However, even when training is finished, there are still major costs. A traditional SaaS app, once built, costs almost zero for additional user that signs up. That's not quite true for AI apps - each text or image generation costs a measurable amount. There are plenty of companies trying to change that, but at least for now, it's not "free" to add more users to an AI product. Startups that pretend otherwise are likely subsidizing growth with investment.

On paper, AI companies are in bit of a bind. It takes serious capital to build and train new foundation models, but the ROI is far from certain. GitHub Copilot is the only product I'm aware of that's making over $100 million in revenue and isn't losing tons of money in the process. Though when you consider the training costs, it's unclear whether Copilot is net profitable over its entire history.

Who then, can bankroll new AI development, without the certainty of financial returns? Big tech companies in general; cloud platforms to be specific.

Meet the new boss, same as the old boss

OpenAI kicked off the current wave of billion-dollar funding rounds when it closed a massive investment from Microsoft last year. The details have never been made public, but it has long been rumored to have been a $10 billion deal.

At first, it was unclear why 1) OpenAI needed so much capital, and 2) Microsoft agreed to give it to them. GPT-3 was an interesting demo, and ChatGPT has just become a viral sensation - but these deals take time to prepare, meaning Microsoft had decided to invest long before ChatGPT went live. It wasn't until the release of GPT-4, Bing Chat, and Microsoft's many Copilots, that the logic behind the deal became clear.

Satya Nadella had glimpsed the next big technology platform shift, and had an opportunity to own a piece of it.

In the months since, the rest of the world has caught up to that perspective. Amid industry-wide layoffs in tech, AI companies are the one bright spot. Companies can raise hundreds of millions (and in the case of Anthropic and OpenAI, billions) from investors.

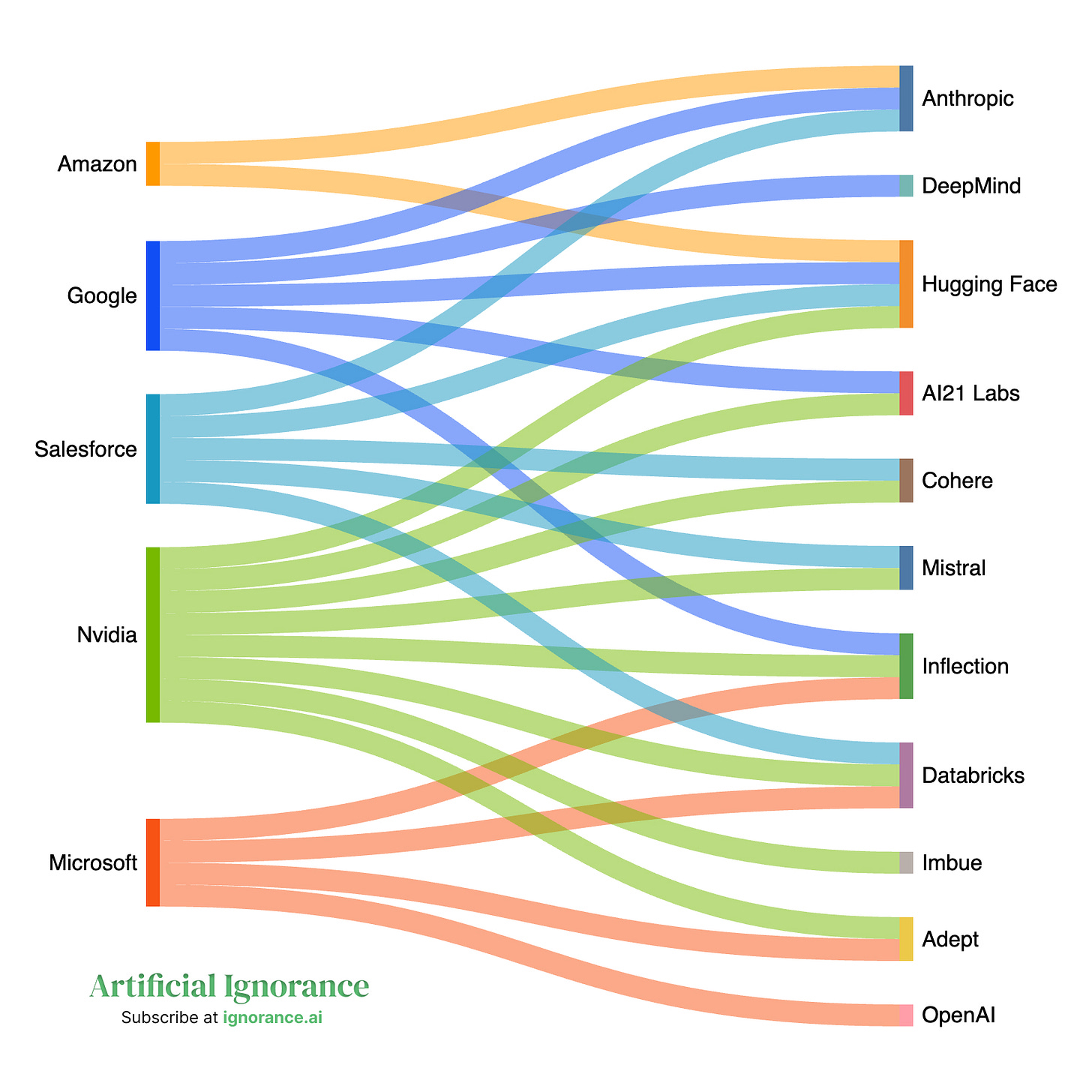

From the outside, it seems like there's an enormous amount of competition. Every other week brings new launches and new comparisons: Is DALL-E 3 better than Midjourney? Will Google Gemini finally dethrone GPT-4? But if we look at some of the best-funded AI companies, there's a surprising trend. Many of them have taken money from the same five names: Amazon, Google, Microsoft, Nvidia, and Salesforce1.

Below are ten of the best-funded AI companies. Of these ten, only two (Cerebras and Scale AI) haven't taken investment from one of the five tech companies mentioned.

And here's how the investments break down.

It's worth noting that the biggest investors are infrastructure and cloud providers. When people ask "who are the winners of the AI boom?" - the clearest answer so far is Nvidia. The company has a fantastic position in both hardware and software, and is reaping the rewards in the form of a trillion dollar market cap. Startups are receiving millions from Nvidia and sending them right back to buy more GPUs.

Beyond Nvidia, cloud platforms like GCP, AWS, and Azure will benefit from increased AI adoption and usage - and they seem to be going all-in on investing in that future. If you can't afford Nvidia GPUs yourself, you'll be paying for a cloud platform to run your models instead. Google is a fascinating player here, considering they own DeepMind, the most advanced competitor to OpenAI. Whether it's an intentional strategy or not, Google is hedging its AI bets.

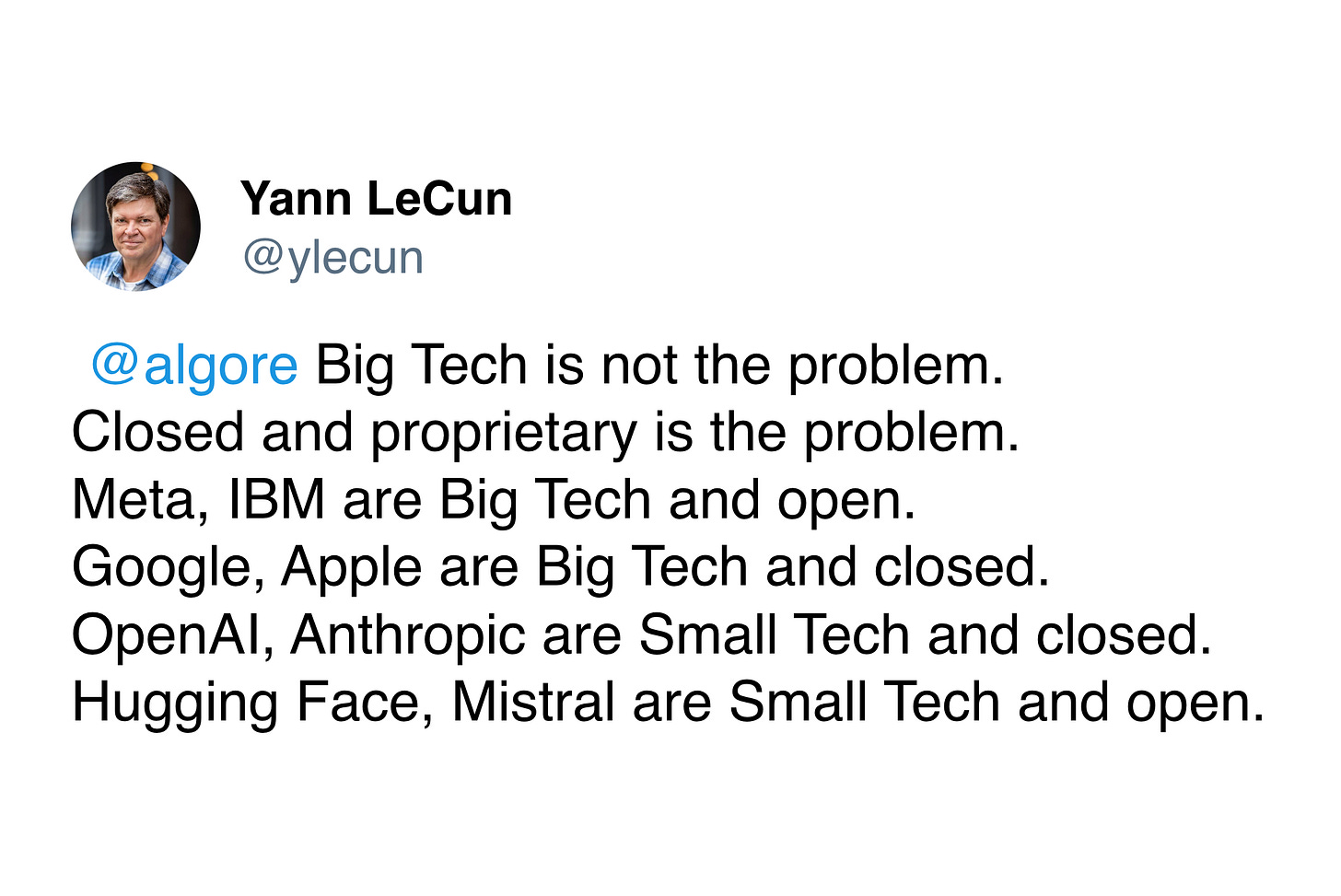

When I think of big tech today, there's Google (aka Alphabet), Amazon, Microsoft, Meta, and Apple. Of those, the first three are all over these investments, while Apple and Meta are nowhere to be found. And while we (still) don't know Apple's generative AI plans, Meta is playing a big role in the AI landscape.

Meta's chaos monkey

In a way, the biggest obstacle to Microsoft, Google, and others controlling the next generation of AI technology is Meta. Rather than invest in AI startups, Meta's strategy seems to be to develop cutting edge models, and then openly release2 them.

Despite not having many flashy AI products until very recently, Meta is actually an AI research powerhouse. Yann LeCun, one of the "godfathers of AI," has led research teams at Meta for over a decade. And he's one of the biggest AI researchers pushing back on the "AGI is going to kill us all" narrative. Altogether, Meta's AI teams have put out over a thousand publications - a staggering number.

After its original Llama model leaked, the company adopted a stance of publishing not only the model code (which many others have done) but also the model weights - the "secret sauce" that's needed to replicate the models. Their flagship model is Llama 2, a ChatGPT competitor, but there's a growing list of other open models. They cover transcription, translation, coding, computer vision, and more.

By making it so (almost) anyone can run Llama 2, or any other foundation model, Meta is attempting to build the AI industry standards of the future. And by doing so, commoditize the proprietary models that its competitors currently offer. Mark Zuckerberg confirmed some of that on a recent earnings call:

Open source software often becomes an industry standard, and when companies standardize on building with our stack, that then becomes easier to integrate new innovations into our products. That's subtle, but the ability to learn and improve quickly is a huge advantage and being an industry standard enables that.

He mentions some other reasons for going the open source route, including the improved quality from having many eyes and many contributors, as well as the ability to attract top talent by letting them work on industry-defining OSS projects.

Yet despite Meta's efforts to democratize AI, it still controls the training dataset and RLHF process. Its licenses are very permissive, but aren't 100% open-source. And to be honest, I'm not in love with the idea that Mark Zuckerberg may be all that stands between us and the AI dominance of a few companies.

Taking a closer look

Of course, Big Tech's involvement hasn't gone unnoticed by regulators. Just two weeks ago, the FTC opened an inquiry into the billion dollar investments from Microsoft, Amazon, and Google. It was a bit of an unusual inquiry, since the FTC usually focuses on antitrust acquisitions, not investments. But the FTC wants to take a look at how these deals could alter the competitive landscape. FTC Chair Lina Khan said:

History shows that new technologies can create new markets and healthy competition. As companies race to develop and monetize AI, we must guard against tactics that foreclose this opportunity. Our study will shed light on whether investments and partnerships pursued by dominant companies risk distorting innovation and undermining fair competition.

And the FTC isn't alone. In December, British regulators said they were reviewing whether Microsoft's deal with OpenAI should be considered a "merger" and whether it would harm competition in the market. Likewise, the European Commission said it was taking a look at whether its antitrust laws could apply to the deal.

But these investigations are likely to take months, if not years. And personally, I'm not expecting them to result in much concrete action. Which begs the question - how worried should we be about this trend? I think it depends on the ultimate impact of AI. Depending on who you listen to, it might be a bubble, it might be the dawn of a new revolution, or it might be the Pandora's box that leads to humanity's undoing. But let's put aside the AI apocalypse for a moment.

In the pursuit of progress, you want new blood, new talent, and new ideas. It's one of the reasons why industry moves so much faster than academia - companies don't wait for their elders to die before embracing new ideas.

If AI proves to be an important (but not earth-shattering) invention, we'll see the incumbents benefit. They'll adopt and distribute AI faster than the upstarts, and we'll see the continuation of recent trends. Big tech companies will offer AI products for cheap (or free), will collect our data for ads and training runs, and will mostly focus on B2B/B2C use cases for generative AI. That's not ideal, but it's a solvable problem.

But if the techno-optimists are right, and AI reshapes the entire world... In that case, concentrating AI into the hands of a few could mean putting a cap on the potential of humanity as a species.

I don't know which scenario will come to pass. I'm not sure anyone does. Clearly governments are concerned enough about AI that they're ensuring we do something to regulate them. But with all the ongoing rules, laws, and executive orders, it seems worthwhile trying to make AI (safely) available to more than a few gatekeepers.

For simplicity, I'm somewhat cavalierly using the term “Big Tech,” even though that's not 100% accurate. Nvidia is a hardware company, and Salesforce is not one of the usual suspects. But the other three (Amazon, Google, and Microsoft) are pretty clearly "Big Tech" companies.

Whether or not Meta is truly "open-sourcing" its models has been a somewhat contentious topic. The company has publicly released its models and their weights, but has placed restrictions on who can use them - specifically prohibiting companies with over 700 million DAUs.

It's so weird: I got really interested in stocks around 2018, and got pretty good at investing/trading during the pandemic (me and Gen Z, I guess). I read through all of Buffett's letters to shareholders, and since then I've devoured maybe 50 books on investing (audible, mind you - I'm not some psycho or something). I thought a lot about that hype cycle that I lived through in 1995-2000, and how fascinating it would be to live through a similar mania.

I thought maybe that mania was here with crypto, but then meme stonks stole the stage, but both of those combined pale in comparison to this wave. Like the dot com bubble, the claims of fantastic things in the future will, in fact, come true, but like dot com, many people will lose their shirts.