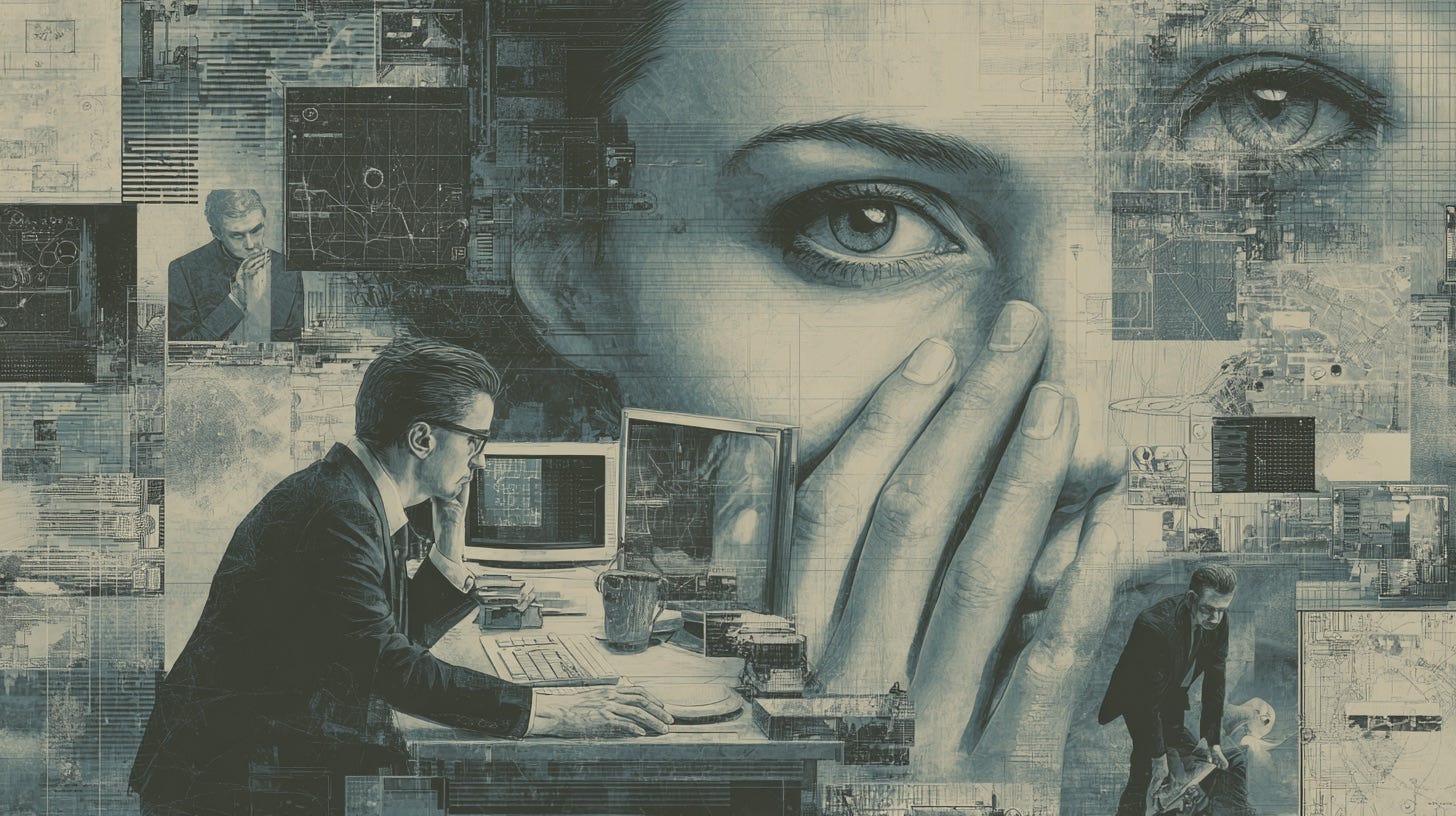

Agentic espionage

Anthropic has disclosed what it believes is the first large-scale cyberattack executed almost entirely by AI agents, with a Chinese state-sponsored group using Claude Code to autonomously infiltrate roughly thirty global targets.

The big picture:

The automation level marks a significant escalation: AI handled 80-90% of the operation with only 4-6 critical human decision points, performing reconnaissance, writing exploit code, harvesting credentials, and extracting data at thousands of requests per second.

Weirdly, this may be a bullish signal for American AI labs. The attacks come as US export controls create acute semiconductor shortages in China, prompting companies to resort to smuggling and workarounds - implying that it may be more effective or reliable to use Anthropic’s models over Chinese ones.

Ultimately, the incident underscores AI’s dual-use dilemma: the same tools designed to strengthen cybersecurity defenses can be weaponized to supercharge attacks, creating an arms race where defenders must maintain a “substantial permanent advantage” or risk losing ground to increasingly automated threats.

Elsewhere in AI geopolitics:

The UK proposes an amendment to the Crime and Policing Bill that would let “authorized testers“ proactively assess AI models for their ability to generate CSAM.

A Munich court sides with Germany’s music rights society GEMA in a case against OpenAI, saying OpenAI can’t use song lyrics without a license.

The European Commission plans to simplify some of its privacy rules, including GDPR, to boost AI growth and slash red tape for businesses in Europe.

Anthropic open sources a method to score AI model political evenhandedness, with Gemini 2.5 Pro scoring 97%, Grok 4 at 96%, Claude Opus 4.1 at 95%, GPT-5 at 89%, and Llama 4 at 66%.

OpenAI asks a US federal judge to reverse an order requiring it to turn over 20M anonymized ChatGPT chat logs in the NYT’s copyright lawsuit, citing privacy concerns.

And an investigation traces how Shanghai-based AI startup INF Tech accessed advanced Nvidia chips in Jakarta, despite US export controls.

Elsewhere in AI anxiety:

US schools are increasingly adopting AI-powered monitoring tools like GoGuardian to scan students’ chatbot conversations for signs of self-harm.

A group of lawyers has documented 533 cases of AI misuse in legal filings, including fabricated case law citations, even as judges and bar associations permit AI use.

Seven lawsuits in California claim ChatGPT encouraged dangerous discussions that led to suicides and harmful delusions.

And in DeepSeek’s first public appearance since R1’s success, a senior researcher told a state-run conference he was pessimistic about AI’s impact on humanity.

End of an era

Yann LeCun, Meta’s chief AI scientist and Turing Award winner, is planning to leave the company to start his own venture.

The big picture:

LeCun’s exit represents a fundamental clash of visions: he believes current large language models will never achieve human-level reasoning - yet Zuckerberg has bet Meta’s future on rapidly deploying LLM-based products.

The Frenchman will be following another AI pioneer, Fei-Fei Li, in developing “world models” - AI systems that learn from spatial and video data rather than text. Li’s startup, World Labs, debuted Marble, its first publicly available model, which turns prompts and photos into editable 3D environments.

With mounting Wall Street pressure on Zuckerberg’s $100B+ AI spending, Meta appears to be sacrificing long-term moonshots for short-term competitive positioning - disbanded the patient, academic approach of the FAIR lab in favor of exclusive teams poaching talent from OpenAI and Google.

Elsewhere in the FAANG free-for-all:

LinkedIn rolls out AI-powered people search to Premium subscribers in the US, with plans to expand globally in the coming months.

Alibaba plans to rename its AI app Tongyi to Qwen and add agentic AI shopping features for platforms like Taobao.

A deep dive examines Microsoft’s AI strategy, including its OpenAI deal, data center investments, GitHub Copilot, MAI models, and Maia chip.

Google unveils Private AI Compute, a cloud platform providing a secure space to run AI tools on devices, similar to Apple’s Private Cloud Compute.

And Google rolls out Nano Banana image editing upgrades in Google Photos, including a “Help me edit” feature that lets users make edits using text or voice prompts.

Elsewhere in frontier models:

OpenAI rolls out GPT-5.1 Instant, which is “warmer by default”, and GPT-5.1 Thinking, which is “easier to understand and faster”, starting with paid subscribers.

Baidu unveils Ernie 5.0, an AI model to process and generate text, images, audio, and video, claiming it beats GPT-5-High and Gemini 2.5 Pro on some benchmarks.

Google DeepMind unveils SIMA 2, a video-game-playing agent built on top of Gemini to navigate and solve problems inside 3D virtual worlds like Goat Simulator 3.

OpenAI is piloting group chats in ChatGPT, with up to 20 users able to prompt ChatGPT in a shared space.

And Meta releases Omnilingual Automatic Speech Recognition, a suite of AI models handling automatic speech recognition for 1,600+ languages, vs. OpenAI Whisper’s 99.

Moonshots vs Margins

Financial documents reveal that Anthropic expects to break even by 2028 while OpenAI won’t turn profitable until 2030, reflecting fundamentally different strategies in the AI race - one focused on sustainable growth, the other on ambitious moonshots.

The big picture:

OpenAI is spending aggressively to maintain its lead, with projected losses of $74 billion in 2028 and commitments totaling $1.4 trillion over eight years. Anthropic is taking a more conservative path, focusing on enterprise customers (80% of revenue), avoiding costly ventures into image and video generation, and growing costs more in line with revenue.

And yet - Anthropic is still getting into the infrastructure game, with a $50 billion plan to build AI data centers in partnership with Fluidstack, starting with facilities in Texas and New York.

The divergence is testing investor patience at a critical moment, with tech stocks being punished over AI spending concerns and skepticism mounting over the industry’s massive financial commitments. Anthropic’s path to profitability may prove prescient - or OpenAI’s massive upfront investment could cement its market dominance if demand continues surging.

Elsewhere in AI infrastructure:

Baidu unveiled two AI chips: the M100 for efficient MoE inference coming in early 2026, and the M300 for training super-large multimodal models coming in 2027.

Several of Asia’s top tycoons and conglomerates are joining the data center race as tech giants plan $240B in APAC hyperscale expansion over the next five years.

Microsoft will spend $10B to build a data center park in Sines, Portugal, in partnership with Portuguese developer Start Campus and UK startup Nscale.

Meta says it will invest $600B in US infrastructure and jobs by 2028, with Zuckerberg telling Trump at a September dinner that Meta will spend “at least $600B.”

And Elon Musk says Tesla is “probably going to have to build a gigantic chip fab“ for AI chips and “maybe, we’ll do something with Intel.”

Things happen

Intel CTO and AI officer Sachin Katti is leaving to join OpenAI. A inside look working at Cursor for 60 days. Six models traded $10K on crypto derivatives; Qwen3 Max lost $652 while GPT-5 lost $5,679. Amazon’s House of David Season 2 had 350 to 400 AI-generated shots. Cursor crosses $1B in annualized revenue. Free access to ChatGPT and Gemini suggests India may be the biggest bet for broad AI adoption. SoftBank sold its entire Nvidia stake for $5.8B in October. OpenAI is piloting group chats in ChatGPT in Japan, New Zealand, South Korea, and Taiwan. Pakistani newspaper mistakenly prints AI prompt with the article. AI is Dunning-Kruger as a service. ElevenLabs’s new Iconic Voice Marketplace for licensing AI versions of famous voices like Michael Caine’s. Kagi Search launches SlopStop, a community-driven AI slop detector. Nano Banana can be prompt engineered for nuanced AI image generation. How China ramped up its AI development from spring 2024 to catch the US. OpenAI’s Sora 2 floods social media with videos of women being strangled. Nasdaq had its worst 5-day run since April as AI stocks fell by about $800B.