Opus Day

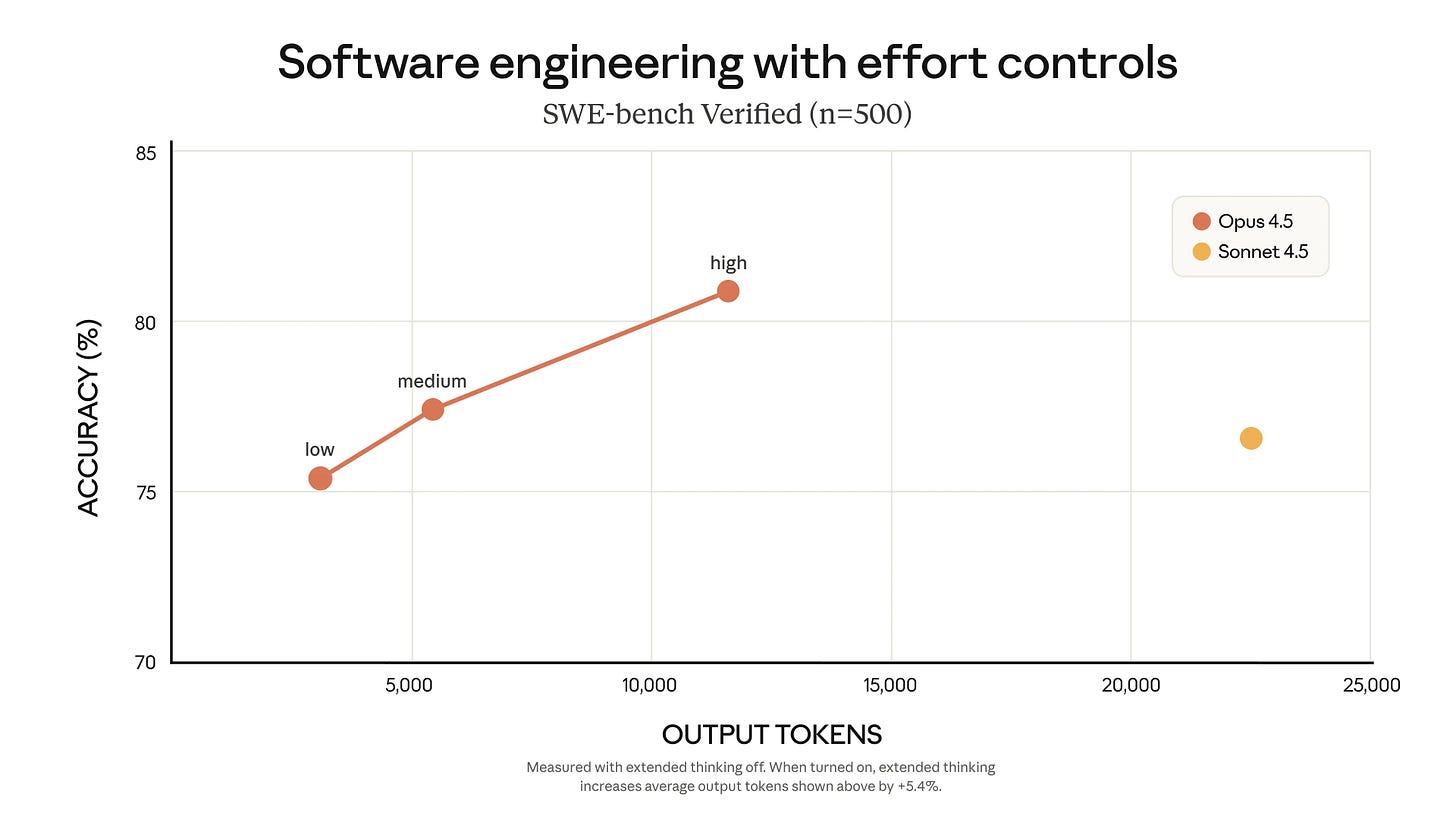

Anthropic released Claude Opus 4.5 on Monday, reclaiming the crown for best coding model with an 80.9% score on SWE-Bench Verified. The release caps a frenetic week of AI lab competition, coming just days after OpenAI’s GPT-5.1-Codex-Max and Google’s Gemini 3 Pro.

What to watch:

The new model is dramatically cheaper than the previous Opus release ($5/$25 per million tokens, as opposed to the previous $15/$75), meaning it may actually be cost-effective to use Opus widely as a base model - especially considering it matches its predecessor Sonnet 4.5’s performance while using 76% fewer tokens.

With this release, Anthropic finally restores its three-tier model hierarchy after Sonnet 4.5 had been outperforming the older Opus 4.1, giving developers clear choices across price-performance curves rather than forcing everyone to upgrade to the flagship model.

For developers, Anthropic is also releasing three new features to help Claude work with massive tool libraries: Tool Search Tool (for discovering tools on demand), Programmatic Tool Calling (for executing tools through code), and Tool Use Examples (for demonstrating correct usage patterns).

But all these rapid-fire releases expose a growing evaluation problem: Even Simon Willison struggled to distinguish Opus 4.5’s real-world capabilities from its predecessor Sonnet 4.5, noting he “kept on working at the same pace“ after switching back - suggesting frontier models may be converging faster than our ability to meaningfully differentiate them.

Elsewhere in frontier models:

Microsoft unveils Fara-7B, its first agentic small language model designed for computer use, available as an experimental release on Hugging Face and Microsoft Foundry.

An analysis of Gemini 3’s model card and safety framework report finds the model is excellent but the safety report withholds or makes it difficult to understand key information.

Ilya Sutskever discusses model jaggedness, why we are moving beyond the “age of scaling,” and SSI’s plan to straight-shot superintelligence in a new Q&A.

OpenAI merges ChatGPT’s voice mode directly into the main text chat interface by default, though users can still switch back to the original separate voice mode.

And OpenAI unveils a free shopping research feature in ChatGPT that delivers a personalized buyer’s guide, powered by a custom version of GPT-5 mini.

Short-term memory loss

A severe memory chip shortage, driven by surging demand for AI infrastructure, is threatening to disrupt supply chains across the tech industry. Major manufacturers, including Dell and HP, are warning of unprecedented cost increases that will inevitably be passed on to consumers.

The big picture:

The crunch stems from manufacturers prioritizing production of advanced, high-bandwidth memory for profitable AI systems over conventional memory chips used in everyday devices - from smartphones and PCs to medical equipment and cars.

Some companies, like Apple, are leveraging their scale and long-term contracts to secure supply and potentially gain market share. Others, like Lenovo, have begun stockpiling memory inventories up to 50% higher than normal levels, as memory chip prices are forecast to rise 50% through mid-2026.

The shortage is becoming a bottleneck for the broader tech ecosystem: Logic chip suppliers may see reduced orders if customers can’t secure accompanying memory, while U.S. sanctions limiting Chinese chipmakers’ capabilities are exacerbating supply constraints just as panic buying intensifies the crisis.

The timing creates a frustrating moment for consumers - GPU prices are finally normalizing after years of volatility, making graphics cards affordable just as the cost of building or upgrading a PC has become prohibitively expensive due to memory shortages.

Elsewhere in AI infrastructure:

Google’s head of AI infrastructure says the company must double AI compute capacity every six months to meet demand.

Meta enters electricity trading to help accelerate the construction of new US power plants critical for its AI infrastructure buildout.

AWS announces a commitment to invest up to $50B to build AI and HPC infrastructure for the US government, starting in 2026 and adding nearly 1.3 GW of capacity.

Foxconn Chair Young Liu says the company will spend $2B to $3B per year in AI in the next three to five years and is discussing potential investments with Japan.

And since 2023, data center power demands have delayed 15 coal plants’ retirements as the Trump administration has ordered two power plants to remain open.

Chip shot

Google is intensifying its challenge to Nvidia’s AI chip dominance by pitching major customers on using its Tensor Processing Units (TPUs) in their own data centers, with Meta reportedly considering a multi-billion-dollar deal for 2027.

Between the lines:

The move prompted Nvidia’s stock to fall 3% and drew a swift public response from the chip giant, which declared its technology remains “a generation ahead” of alternatives like Google’s TPUs.

It’s also throwing its war chest around - Nvidia CEO Jensen Huang has been proactively countering Google’s moves by investing billions in Anthropic and OpenAI after they explored TPU deals, essentially using capital to maintain GPU lock-in even as Google offers cheaper alternatives.

Google’s recent technical progress with Gemini 3 and seven generations of TPU development may finally be paying off - Meta is reportedly interested in using TPUs for model training, not just inference, which many had assumed was Nvidia’s unassailable stronghold.

Elsewhere in the FAANG free-for-all:

Google is starting to bridge OpenAI’s product moat with Gemini’s “dynamic view” option, which converts text answers into interactive, visual outputs.

A job listing shows Google is developing a new Android-based “Aluminium OS” that is “built with AI at the core”, potentially as a ChromeOS replacement for PCs.

Meta plans to test an AI-powered personalized daily briefing, designed to compete with ChatGPT’s Pulse, with some Facebook users in NYC and SF.

Google says ads that some users are seeing in AI Mode are part of a test; the ads have a “sponsored” label and appear at the bottom of the page.

And Amazon unveils its Autonomous Threat Analysis system, born from a 2024 internal hackathon, to use AI agents competing in teams to identify vulnerabilities.

Open season

China has surpassed the US in downloads of “open” AI models on Hugging Face for the first time, capturing 17% market share versus America’s 15.8%, as Beijing encourages its tech companies to release freely accessible models while US giants like OpenAI and Google maintain closed, proprietary systems.

The big picture:

Led by DeepSeek and Alibaba’s Qwen models, Chinese AI developers are releasing models weekly at dramatically lower costs - while American tech leaders like OpenAI, Google, and Anthropic maintain tight control over their “closed” proprietary technology to protect lucrative subscription businesses.

Likewise, foreign investors are warming to China’s AI sector precisely because it lacks the bubble characteristics plaguing US tech, with venture capital firms raising hundreds of millions in recent months to back Chinese startups at valuations one-quarter of American peers.

But China’s open-source dominance comes with ideological strings attached: researchers have documented that Chinese models embed Communist Party biases and refuse to generate information on sensitive topics like Taiwan or Tiananmen Square, meaning widespread adoption could shape global information flows.

Elsewhere in AI geopolitics:

Italy’s competition regulator is scrutinizing a Meta policy that excludes rival AI chatbots from WhatsApp, broadening the scope of a probe started in July.

The US House Homeland Security Committee asks Dario Amodei to testify at a December 17 hearing on how Chinese state actors used Claude Code for cyber-espionage.

A new network of super PACs plans to raise ~$50M to counter the Leading the Future super PAC and back candidates who prioritize AI regulations.

Trump signs an EO establishing the Genesis Mission to boost AI innovation, including by using federal scientific datasets to train models and create AI agents.

New York’s RAISE Act would require AI companies to publish safety protocols and disclose serious incidents, as its co-sponsor is targeted by a pro-AI super PAC.

And the UK announces a £100M plan to support local AI hardware startups via guaranteed “first customer” payments, estimating its AI market to be worth over £72B.

Elsewhere in AI anxiety:

An MIT study finds that AI can replace 11.7% of the US labor market, or ~$1.2T in wages, based on the “Iceberg Index” which measures job automation potential.

Anthropic finds that LLMs trained to “reward hack” by cheating on coding tasks show even more misaligned behavior, including sabotaging AI-safety research.

Major insurers have recently sought permission from US regulators to offer policies excluding liabilities tied to businesses deploying AI chatbots and agents.

While the AI bubble feels like the internet bubble of 1999, it may actually be larger and scarier with an unstable US economy and greater exposure for Big Tech.

Researchers say Russia-aligned Pravda network is engaging in “LLM grooming”, flooding the internet with disinformation to influence chatbots like ChatGPT.

And interviews with current and former OpenAI employees detail how updates that made ChatGPT more appealing to boost growth sent some users into delusional spirals.

Things happen

Epic games CEO says it makes no sense to label AI-made games since AI will be in everything. Report: Suno spent $32M on compute and $2K on data. 73% of AI startups are just prompt engineering. PopEVE predicts disease-causing mutations better than AlphaMissense. Indian startups are building LLMs for low-resource languages from scratch.Amazon begins previewing Leo satellite internet ahead of 2026 launch. Sam Altman and Jony Ive say their OpenAI device could arrive in less than two years. The bitter lesson of LLM extensions. The USPTO clarifies that AI cannot be an inventor. Character.AI is cutting off ongoing chats for users under 18. Figure AI’s former head of product safety sues the company for wrongful termination. An AI agent bypasses bot detection on online surveys nearly flawlessly. Amazon pushes engineers to use Kiro over Cursor. The humanoid robotics industry relies heavily on hype. Food bloggers warn AI Overviews are burying real recipes. A Mixpanel breach exposed OpenAI API data; OpenAI terminated its use. I don’t care how well your AI works. Replace your boss before they replace you. Karpathy on the implications of AI to schools. PRC elites voice AI-skepticism. Altman: Google’s AI progress could create economic headwinds for OpenAI. The AI workers tell their friends and family to stay away from AI. We’re losing our voice to LLMs.

Thanks for the good 😊